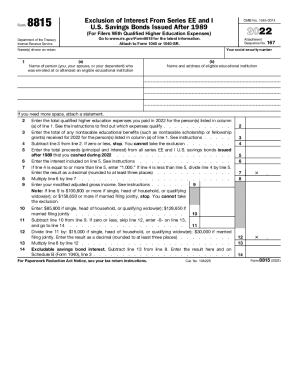

IRS 8815 2023-2024 free printable template

Get, Create, Make and Sign

Editing irs form 8815 online

IRS 8815 Form Versions

About irs form 8815

How to fill out irs form 8815 2023-2024

How to fill out series ee savings bond

Who needs series ee savings bond?

Video instructions and help with filling out and completing irs form 8815

Instructions and Help about us savings bonds rates form

[Music] all wages salaries and tips you received for performing services as an employee of an employer must be included in your gross income amounts withheld for taxes including but not limited to income tax Social Security and Medicare taxes are considered received and must be included in gross income in the year they're withheld generally your employers contribution to a qualified pension plan for you isn't included in gross income at the time it's contributed additionally while amounts withheld under certain salary reduction agreements with your employer are generally excluded from gross income such amounts may have to be included in wages subject to Social Security and Medicare taxes in the year they're withheld see publication 17 chapter 5 wages salaries and other earnings and chapter 6 tip income for specific information on IRS website your employer should provide you a form w2 showing your total income and withholding you must include all income and withholding from all forms w2 you receive on your tax return and if filing jointly you must also include all income and withholding from your spouse's forms w2 attach a copy of each form w2 to the front of your tax return as indicated in the instructions please note that self-employment income is generally reported on form 1099 MIS C for more information on business income refer to tropic 407 business income publication 334 tax guides for small business and self-employment income on IRS website for information on tips refer to publication 531 reporting tip income publication 1240 for employees daily record of tips and report to employer topic 761 tips withholding and reporting on IRS website also consider is my tip income taxable interview on IRS website for information on excess Social Security or railroad tax withholding refer to topic 608 excess Social Security and RRT a tax withheld if you receive a forum w2 after you've filed your return file an amended tax return form 1040x for more information on amended returns refer to topic 308 and amended returns your form w2 should be made available to you by January 31st for information about incorrect forms w2 or non receipt refer to topic 154 form w2 and form 1099 our what to do if incorrect or not received [Music] [Music]

Fill 8815 form : Try Risk Free

People Also Ask about irs form 8815

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Fill out your irs form 8815 2023-2024 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Form 8815 is not the form you're looking for?Search for another form here.

Quick facts to know before filling out the form